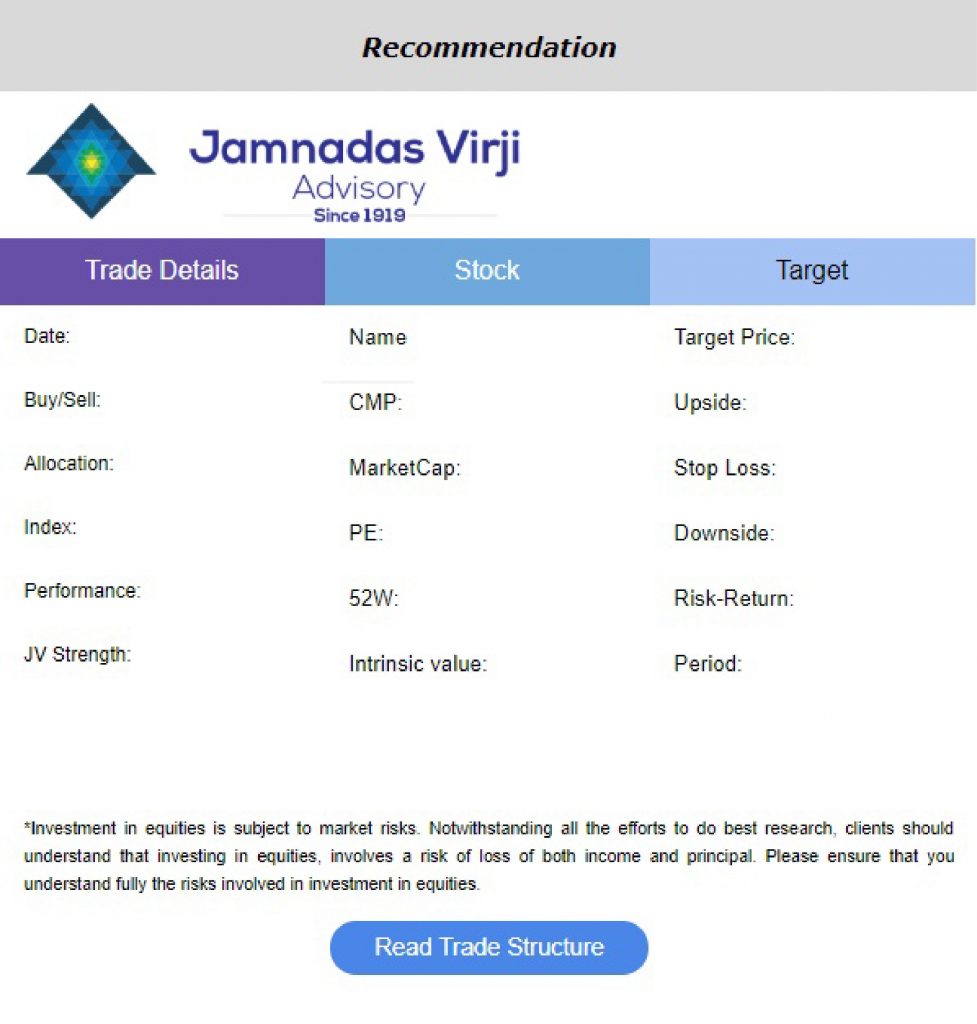

The recommendation will be sent to you in the format mentioned below by email. The SMS & Chat format will be the same with similar elements but design may vary.

Trade Details

Date: The date of recommendation.

Buy/Sell: (Buy= Purchase the stock in recommended quantity/as per your requirement) (Sell= Reduce the current quantity as per recommended/ your requirement) *Not a recommendation to SHORT SELL.

Index: The closing price of the index as per previous day close.

Allocation: The recommended capital to be allocated to this trade. (Will be in percentage)

Performance: The historic CAGR return of the share price.

JV Strength: The presumed strength of the recommendation, += Least confident | +++++= Most confident.

Stock

Name: The name of the company.

CMP: The current market price of the company.

Market Cap: The total market capitalization of the company as well as if its a Small, Mid, Large category.

PE: The Price to Earnings ratio, indicates the valuation multiple of the company.

52W: The 52 week high and low of the company.

Intrinsic Value: The fair value of the company calculated by Jamnadas Virji Advisory.

Target

Target Price: The expected price of the stock as per our projections.

Upside: The percentage move on the upside from the purchased price as recommended.

Stoploss: The price at which the trade needs to be exited, at a maximum loss, predefined while recommended.

Downside: The percentage of maximum loss on the recommended trade from the purchase price.

Risk-Return: How favorable the recommended trade is in terms of risk taken to the return expected. (If the ratio is 0.1 then for Rs.1 of return the risk is 10 paise. All trades with Risk-Return 1.0 will mean we are taking Rs.1 risk to earn Rs.1)

Period: The period of holding the stock recommended.

Setting up your portfolio

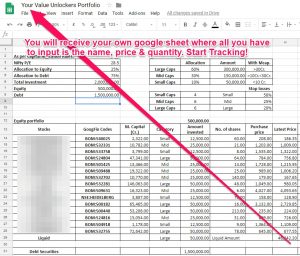

We will provide you access to our current portfolio’s for you to be able to place your portfolio as per ours in the same manner. We will also repeatedly send you updates about the additions and subtractions and changes in capital allocation etc. on an ongoing and instant basis. We will also provide you with a google sheet where you can track your portfolio in the same manner as we do, hence you will be able to track your returns in the same manner.

![]()

Track details such as capital allocation, MarketCap allocation, returns and much more of the Model portfolio on our performance page.

Input name, price and quantity on the google sheet we send you, and get a detailed analysis of your portfolio.

![]()

Get a professional portfolio without paying the professional fees and share of your profits to portfolio managers.